Bond Construction Progress Questions

- Are businesses and second homes (non-homestead) and primary homes (homestead) treated the same regarding bond millage?

- Are technology purchases going to be amortized over a 23-year period? Is there a technology replacement plan?

- At what point would the State of Michigan, as well as the local fire and police departments, provide input into the bond projects?

- How does the district plan to accommodate student population growth?

- How does the November 5, 2019 bond proposal differ from the proposal that was recently passed by voters?

- How is an absent voter ballot obtained?

- How much has the district grown?

- How much money would the bond proposal generate?

- How would I know the bond funds would be spent the way they are supposed to be spent?

- How would the bond proposal impact my homeowner property taxes?

- If I rent a house, can I vote?

- Is the debt millage rate expected to be the same over the life of the bond?

- Is the school district going to immediately issue $139,925,000 of bonds?

- What are the key dates leading up to the Tuesday, November 5, 2019 vote?

- What is a bond proposal and how can funds from a bond be spent?

- What is the purpose of the November 5, 2019 bond proposal?

- What oversights would hold the district accountable?

- When would the new bond proposal be paid off?

- Where and when will the vote occur?

- Where can I find more information about this bond proposal?

- Where would the students go during the proposed construction phases?

- Who was involved in determining what to include in the bond proposal?

- Why are the school buildings proposed to be remodeled and upgraded?

- Will I be able to provide input regarding the design of the buildings?

- Would money from the bond proposal be used to pay teachers’ salaries and benefits?

- Would the approval of the bond proposal have any impact on our current operational budget?

Are businesses and second homes (non-homestead) and primary homes (homestead) treated the same regarding bond millage?

Yes, businesses and second homes (non-homestead) and primary homes (homestead) are treated the same regarding bond millage.

Are technology purchases going to be amortized over a 23-year period? Is there a technology replacement plan?

No. Technology purchases are required to be amortized over a 5-year period beginning at the point of installation. Yes, there is a technology replacement plan and each bond series has an allowance for future technology purchases and updates.

At what point would the State of Michigan, as well as the local fire and police departments, provide input into the bond projects?

Each project will be required to be submitted to both the Bureau of Construction Codes (BCC) and the Bureau of Fire Services (BFS) for both plan review and permitting. These agencies will review the projects to ensure they comply with applicable codes before any building permits are issued. Building plans and specifications must be signed and sealed by a Licensed Architect/Professional Engineer before submission.

As of March 21, 2019, Michigan law requires school districts to consult on the plans for the construction or major renovation regarding school safety issues with the law enforcement agency that is the first responder for that school building. This consultation would happen after a bond proposal has been approved by voters before construction documents are finalized prior to project commencement.

How does the district plan to accommodate student population growth?

For decades, district leaders have been evaluating, planning, and updating long-range plans for school buildings and sites. The current plan is no different from previous plans to address growth – incremental improvements to alleviate building capacity issues. The district works to identify schools with capacity issues and supplements this growth information with enrollment projections. The enrollment projections are formed by studies conducted by Dr. Frederick Ignatovich of Stanfred Consultants, Professor Emeritus, Michigan State University.

The bond proposal addresses student population growth in three ways: a new school, classroom additions to select schools, and gymnasium additions to select schools.

The new school would house fifth and sixth grades and would be located on the north end of the district which is where the greatest amount of student growth has occurred. At this time, it is proposed that the northern elementary schools (Alward, Bauer, Georgetown, and Park) would transition to kindergarten through fourth grade, and the fifth grade would relocate to the new school. At Baldwin Street Middle School, the sixth grade would transition to the new school, and Baldwin would then house seventh and eighth grades. Although not part of this bond issue, growth in the south part of the district would be addressed by mirroring the grade configuration in the north.

Classrooms would be added between the High School and Freshman Campus, connecting the two buildings to become one high school building.

Gymnasiums would be added at select elementary schools that do not currently have separate gyms, including Bauer, Forest Grove, and Park. Currently these buildings use their gym as a cafeteria, so this limits the times students can be in physical education class as they need space for lunch.

Additional school buses would be purchased to supplement the fleet.

How does the November 5, 2019 bond proposal differ from the proposal that was recently passed by voters?

On May 7, 2019 voters approved the district’s operating millage. This is an annual renewal which provides approximately $4.8 million in operational funding to the district. The operations millage renewal is required for districts to receive the full per-pupil funding from the State. These funds are used to pay expenditures such as staffing costs, classroom supplies, textbooks and building operating expenses such as utilities and maintenance costs.

If approved by voters, the November 5, 2019 bond proposal would generate funds for capital improvements. Proceeds can be spent on new construction, facility renovations and additions, site-work such as parking lots, bus loops and playgrounds, buses, furnishings, equipment and technology.

How is an absent voter ballot obtained?

Absent voter ballots are available to any registered voter. Registered voters must complete and submit an application for an absent voter ballot. Your request for an absent voter ballot must be in writing and can be submitted to your city or township clerk. (For assistance in obtaining the address of your local clerk, see Michigan.gov/Vote) You must request an absent voter ballot by mailing the application, a letter, a postcard, or a pre-printed application form obtained from your local clerk's office. Requests to have an absent voter ballot mailed to you must be received by your clerk no later than 5 p.m. the Friday before the election.

Applications are available from your local clerk’s office. You also may obtain an application online at www.mi.gov/sos. Click “Elections in Michigan” on the top menu, and then click on “Information for Voters” then click on “Obtaining an Absent Voter Ballot.” Absent voter ballots are available by September 21 through November 4, 2019.

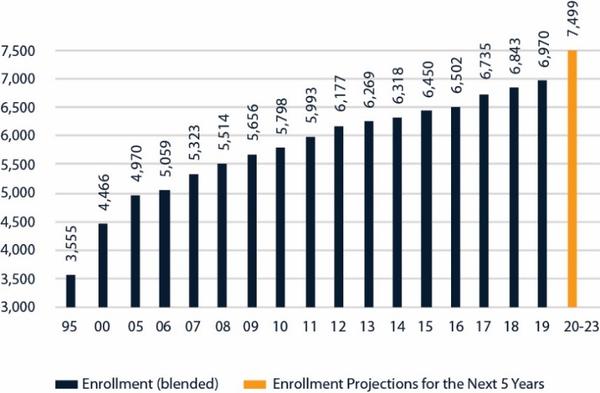

How much has the district grown?

Current enrollment projections indicate the district’s student population could exceed 7,499 in the next five years, which is estimated to be an additional 529 students. In the past 5 years, the district has grown by 652 students. In the past 10 years, the district has grown by 1,314 students. In the past 24 years, the district has grown by 3,415 students.

How much money would the bond proposal generate?

The proposal would generate $139,925,000 which would be spent over seven years on district-wide capital improvements.

How would I know the bond funds would be spent the way they are supposed to be spent?

Michigan law requires that expenditure of bond proceeds must be audited, and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses. An audit would be completed at the end of each project to ensure compliance.

How would the bond proposal impact my homeowner property taxes?

If approved by voters, no tax rate increase is expected for Hudsonville Public Schools taxpayers. The debt tax rate is expected to remain the same but would extend the current rate further into the future.

If I rent a house, can I vote?

Yes, if you rent a house you can still vote. You do need to be a registered voter in the city or township you are living in.

Is the debt millage rate expected to be the same over the life of the bond?

No. The debt millage rate is estimated to remain at 7 mills through 2042, then it is estimated to decline to 2.91 mills, and less the following years, due to bond repayment and taxable value growth. Hudsonville Public Schools participates in the School Loan Revolving Fund which is a self-sustaining State program that allows the district to borrow funds to make full debt service payments rather than increase its current debt millage.

Is the school district going to immediately issue $139,925,000 of bonds?

No. The bonds are proposed to be issued in 2 series (2020 and 2022). This allows for the district to complete a portion of the project before paying interest on the entire bond amount authorized.

What are the key dates leading up to the Tuesday, November 5, 2019 vote?

- • Voting on Election Day:

- Tuesday, November 5, 2019

- Polls will be open from 7:00 am to 8:00 pm

- Absentee Voting: o Absentee voter ballots are available from September 21 until November 4, 2019

- Up to 5:00 p.m. November 1 Electors may obtain an absent voter ballot via First Class mailo Up to 4:00 p.m. November 4 Electors may obtain an absent voter ballot in person in the clerk’s office

- Up to 4:00 p.m. November 5 Emergency absentee voting for general election November 5 Election day registrants may obtain and vote an absent voter ballot in person in the clerk’s office or vote in person in the proper precinct.

- Contact your city/township with questions

What is a bond proposal and how can funds from a bond be spent?

A bond proposal is how a public school district asks its community for authorization to borrow money to pay for capital expenditures. Voter-approved bond funds can be spent on new construction, additions, remodeling, site improvements, athletic facilities, playgrounds, buses, furnishings, equipment, technology, and other capital needs. Funds raised through the sale of bonds cannot be used on operational expenses such as employee salaries and benefits, school supplies, and textbooks. Bond funds must be kept separate from operating funds and must be audited by an independent auditing firm.

What is the purpose of the November 5, 2019 bond proposal?

The purpose of the bond proposal is to address increasing student enrollment in the district and to update aging building infrastructure district-wide.

What oversights would hold the district accountable?

If approved by voters, the district’s Architect/Engineer would design the proposed projects and prepare construction documents and specifications for the projects. Once the projects are designed, the district’s Construction Manager will assemble bid packages and publicly advertise to solicit competitive bids for all work. This is required by law, as outlined in the Revised School Code. This process ensures that the district selects the lowest responsive and responsible bidder. All qualified contractors will have an opportunity to attend a pre-bid meeting to obtain additional information and project clarification. All qualified contractors will have the opportunity to participate in the competitive bid process.

When would the new bond proposal be paid off?

If the bond proposal is approved by voters on November 5, 2019, the final levy for this proposal is expected to be 2051. The maximum number of years the bonds in each series may be outstanding, exclusive of any refunding, is thirty-one (31) years.

Where and when will the vote occur?

Registered voters may cast a ballot at the polling location established by their city/township. If you have questions or do not know where you vote, please contact your city/township office. The election will be held on Tuesday, November 5, 2019. Polls will be open from 7:00 am to 8:00pm.

Where can I find more information about this bond proposal?

- Visit the District website at www.hudsonvillepublicschools.org

- Like us on Facebook at www.facebook.com/hudsonvilleps

- Follow us on Twitter at www.twitter.com/HPSEagles

- Attend a public information forum

- October 8 at 6:30 PM - Baldwin Street Middle School Media Center (3835 Baldwin Street)

- October 9 at 6:30 PM - Freshman Campus Auditorium (3370 Allen Street)

- October 16 at 6:30 PM- Riley Street Middle School Media Center (2745 Riley Street)

Where would the students go during the proposed construction phases?

We do not anticipate a need to relocate students during construction. However, if the need arises, we would work carefully to lay out a plan for our students during the construction. We plan to address schedules and coordinate instructional spaces to minimize disruption.

Who was involved in determining what to include in the bond proposal?

Initial bond planning started with an internal list developed by district administration and operations staff. The initial list was then combined with a district facility assessment. Public forums, staff interviews, and a community survey with over 1,700 participants also helped review and prioritize the scope of the bond proposal. The final determination of scope was made by district administration and the Board of Education.

Why are the school buildings proposed to be remodeled and upgraded?

The district operates 13 school buildings that range in age from 5 to 75 years old. Although these buildings have undergone additions and renovations over the years, some schools haven’t seen significant upgrades in over 10 years. A recent facilities assessment identified specific systems that have exceeded their expected lifecycle(s) – lighting, roofing, HVAC, etc. If the bond proposal is approved, it would include selective replacement of these systems.

| School | Constructed | Age |

|---|---|---|

| ECC | 1951 | 68 |

| Alward | 1955 | 64 |

| Bauer | 1957 | 62 |

| Forest Grove | 1944 | 75 |

| Georgetown | 2006 | 13 |

| Jamestown Lower | 2013 | 6 |

| Jamestown Upper | 1953 | 66 |

| Park | 1957 | 62 |

| South (renovated in 2016) | 1970 | 49 |

| Baldwin | 1996 | 23 |

| Riley | 2000 | 19 |

| Freshman Campus | 2014 | 5 |

| High School | 1960 | 59 |

Will I be able to provide input regarding the design of the buildings?

Yes. If the bond proposal is approved, the community will have the opportunity to participate in the final planning, design, and implementation of the school expansions and improvements. A committee for each building would be created for stakeholders to participate and provide input and feedback.

Would money from the bond proposal be used to pay teachers’ salaries and benefits?

No. School districts are not allowed to use funds from a bond for operating expenses such as teacher, administrator or employee salaries, routine maintenance, or operating costs. Bond revenue must be kept separate from operating funds and bond revenue expenditures must be audited by an independent auditing firm.

Would the approval of the bond proposal have any impact on our current operational budget?

While funding from this bond proposal is independent of the support the district receives from the State of Michigan for annual operations on a per pupil basis, the bond would likely have a positive impact on the annual operating budget for existing facilities. It would allow the district to reallocate operating funds that are currently being spent on aging facilities, mechanical systems, and technology. The savings generated from new and cost-efficient facilities could be redirected to student programs and resources.